Do you want to accept bitcoin loads on your prepaid card but are worried that you will get shut down by Visa or Mastercard?

This is a tricky area. In this article we are going to teach you how you can accept bitcoin loads on your prepaid card. (Note this article is for Program Managers, not consumers).

Visa Smackdown

One of the long-standing obstacles for cryptocurrencies is there is no direct way to spend the currency. You can mine bitcoin, you can buy and sell it, but you cannot buy stuff with it. It is like buying and selling Beanie Babies and then getting upset you cannot buy a pizza with one.

Along came Bitwala. Bitwala and its peers are an important part of this new ecosystem. They provided holders of cryptocurrency the ability to pay for stuff directly.

But it was not to be for long.

Earlier this year, Visa shut down the Bitwala card because they provided direct access to cryptocurrencies through their Visa card product. This sent shock waves through the blockchain community.

As a Prepaid Program Manager, you know there is no greater risk than having your program shut down by your issuing bank or the network. You want to avoid this at all costs…right?

The Loophole

Good news! There is a way around this. Visa allows the currency to be converted to cash outside of the prepaid card. That cash can be then be loaded to the card. (I have questions into MasterCard and Discover and will update the article when I hear back from them.)

Traditionally, you could only cash out bitcoin by selling it on an exchange and transferring that money back to your bank account. This can take 3-5 days. Alternatively, you could transfer bitcoin to someone and they could pay you via a third-party such as PayPal – but this is risky. In fact, that is how the first bitcoin was sold.

Enter a company called BitPay out of Atlanta Georgia. BitPay started as a way to give online merchants a means to accept bitcoin for their goods and services. For example, overstock.com accepts Bitcoin in their online checkout process.

BitPay extended this capability to include prepaid cards. They started with their own card https://bitpay.com/card, issued by Visa on Metropolitan Commercial Bank of New York and has since allowed other Prepaid Card Program Managers to integrate with their service. (Note that this usage is against BitPay’s terms. During the on-boarding process, you need to request a waiver – more about that later).

Keep in mind that one of the restrictions of BitPay is that they currently only allow conversion of bitcoin. But this is okay. I don’t think the industry is ready to mix and mingle with other cryptocurrencies yet.

A quick Primer on Bitcoin

Before I start explaining how to load bitcoin to a prepaid card, let me give you a general overview of how bitcoin works from a currency standpoint.

The first thing you need to do is purchase bitcoin. You can do this through an exchange. One of the more popular exchanges is Coinbase. (Here is my referral link – https://www.coinbase.com/join/5a285e8ac7f50400f72b8c1a. This will give both you and me a $10 bonus if you add $100 to your account. This extra $10 will help cover your fees when doing your initial testing.)

After you sign up for a Coinbase account, you will need to connect a credit card or bank account. Then you can purchase bitcoin at the current market price. If you use a credit card, your purchase is immediate. Be careful though, a lot of credit card companies block purchases at that point. I had to call my credit card’s fraud department to allow my purchase to go through. You can also connect your bank account, however those purchases take a week to settle.

Once you have bitcoin, you can send or sell it through your wallet. A wallet is like a bank account that holds your bitcoin. Wallets can be part of a website like Coinbase, you can have a software wallet on your computer, or you can even print out your wallet. You must have access to the wallet or your bitcoin could be gone for ever.

Here is a good video showing how coinbase works.

How Does loading Bitcoin to a Prepaid Card Work?

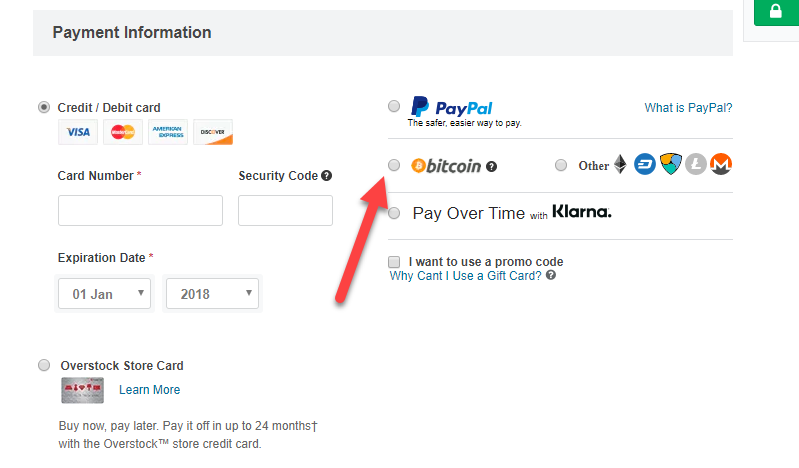

The image above shows the overview steps of what needs to happen from a cardholder’s point of view.

- The cardholder will go to your page to load their bitcoin.

- Your site will use BitPay’s technology to generate a piece of code that acts as a sales receipt. We will call this the sales receipt code.

- Your website should charge the fee and collect it as part of the sale of bitcoin – more on that later.

- The cardholder will need to copy that sales receipt code to their wallet (or scan the QR code). Due to recent changes at BitPay, you now need to transfer your bitcoin to wallets that support a http URL rather than just a code. This change was made because some wallets were not executing the order for a couple of hours. Due to bitcoin’s price fluctuation, the order would fail. More on this at https://support.bitpay.com/hc/en-us/articles/115005559826.

- Once this is done, the cardholder has transferred his bitcoin to BitPay.

- Bitpay will sell the bitcoin and the funds can be loaded to the prepaid card instantly.

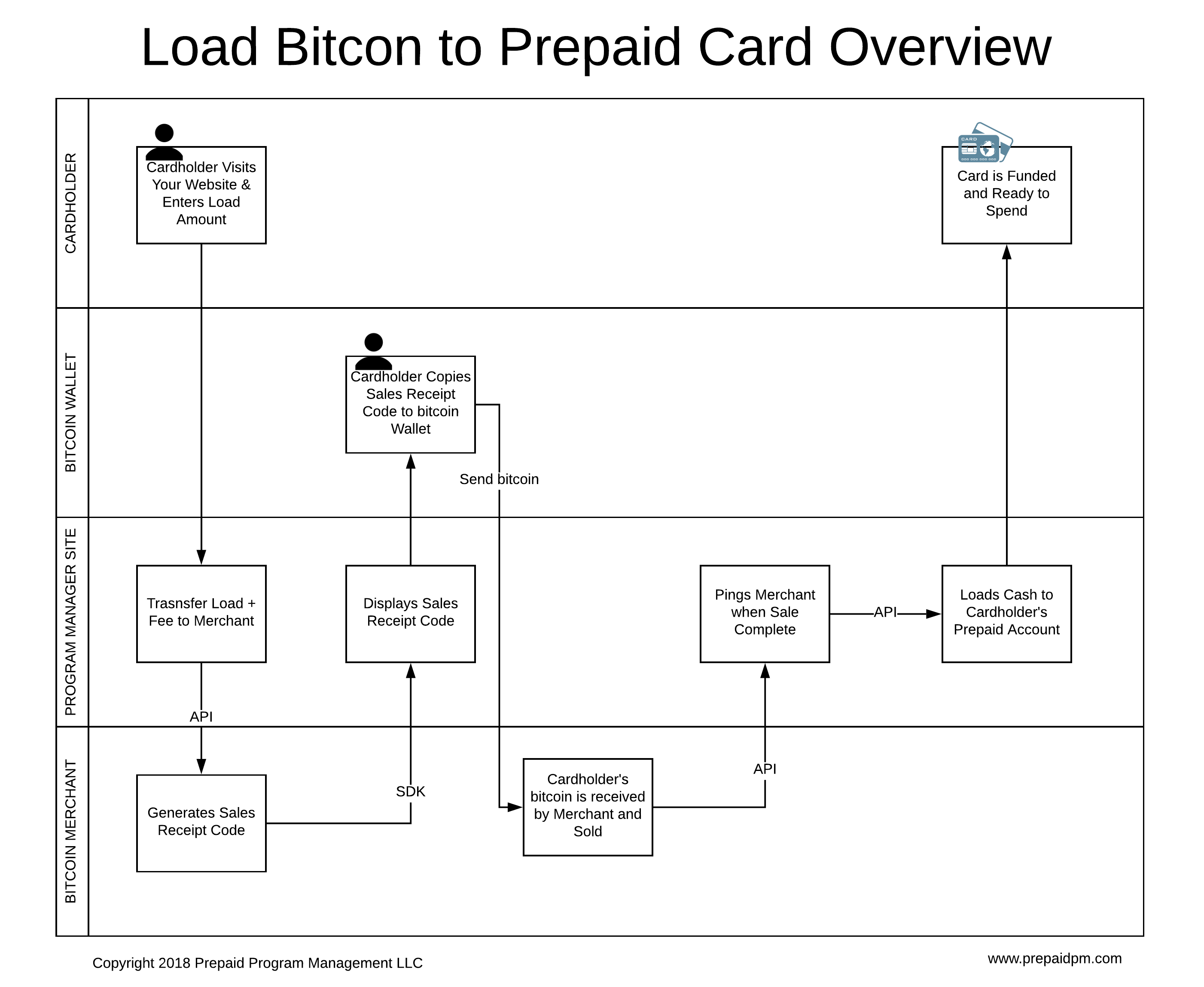

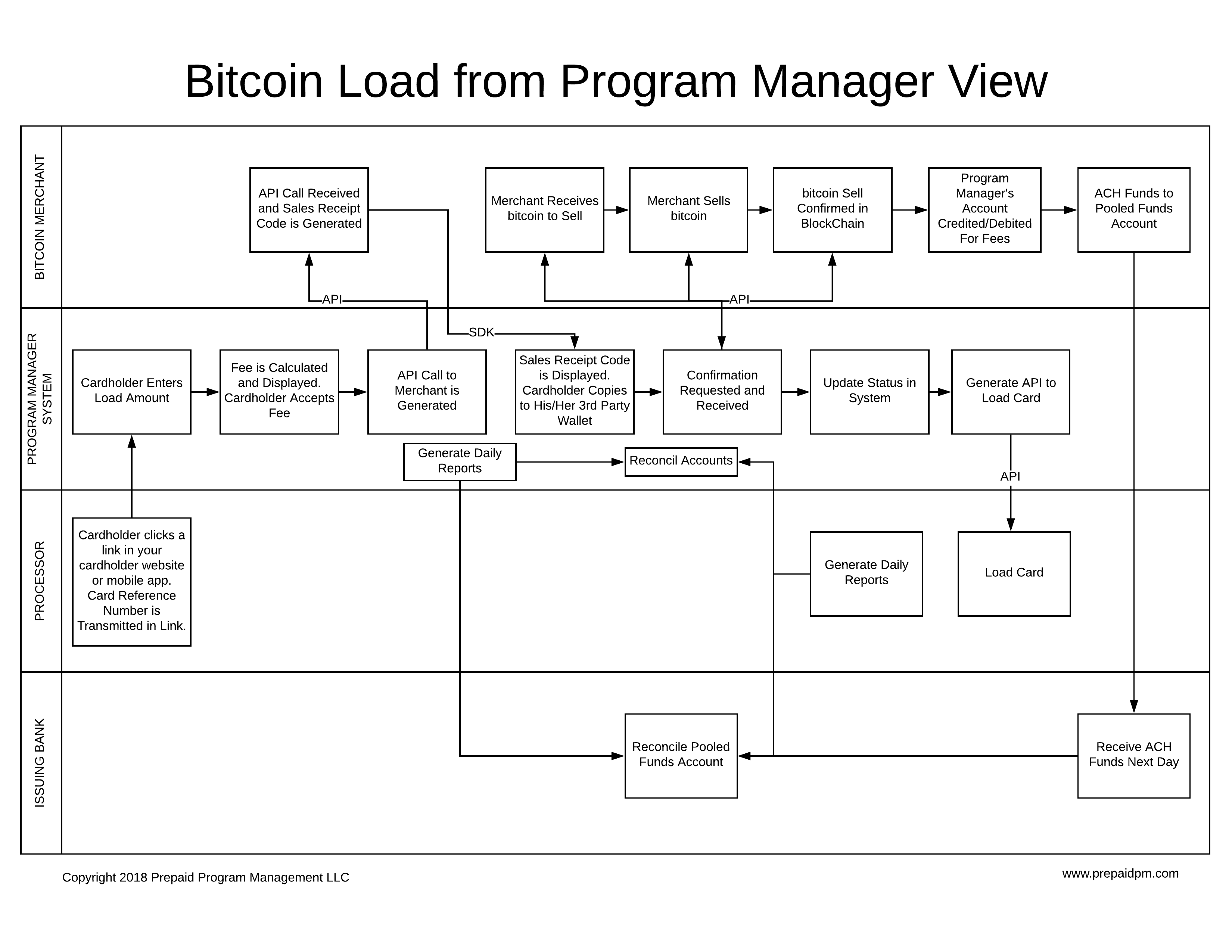

Now, let’s examine the bitcoin load process, a more complex process, from the Program Manager’s point of view.

- You present the cardholder a screen on which to load bitcoin.

- The cardholder enters the amount to load in dollars.

- You tack on your fee and present the total to the cardholder.

- The cardholder accepts the total.

- Your website connects through an API to BitPay to generate the sales receipt code and presents that on screen to the cardholder via an SDK.

- The cardholder copies that code to their wallet.

- Your API receives notice back from BitPay that the previous step was completed and the bitcoin is pending sale.

- BitPay will now sell the bitcoin.

- Your system receives notice a few minutes later that the sale was successful.

- You trigger a load to the prepaid card. This can be in the form of an API load (instant), an ACH load (1-3 days), a batch load (typically overnight) or even a Visa Direct load (instant) (providing that Visa approves this use).

- The funds are available on the card.

- BitPay credits your account minus their fee – 1% at the time of this writing.

- BitPay ACHs the funds to your pooled funds account (ideally minus your fees).

- You reconcile the deposits daily.

Prepaid Card Money Flows

We discussed the money flows at a high level in the above process, but let’s dig deeper into this.

The general rule of thumb for Prepaid Program Managers is that you do not want to touch the money or have it in your possession. Why? You may trigger the need to become a Money Transmitter. Keep in mind that I’m not an attorney, nor are my acting skills good enough to play one on TV. Talk to your attorney about this for clarification.

With this in mind, let’s continue.

Merchant Account’s (BitPay’s) Responsibilities (Money Flows)

The first part of the money flow is to sell the bitcoin. This is accomplished through BitPay. When the cardholder enters the sales receipt code into their wallet, that triggers the transfer of bitcoin to BitPay. Once this is completed, BitPay sells the bitcoin on the market. BitPay is not taking on any risk here. They will sell it quickly and usually the price fluctuations are not so volatile that it will change between the time of the transfer and sell.

The first part of the money flow is to sell the bitcoin. This is accomplished through BitPay. When the cardholder enters the sales receipt code into their wallet, that triggers the transfer of bitcoin to BitPay. Once this is completed, BitPay sells the bitcoin on the market. BitPay is not taking on any risk here. They will sell it quickly and usually the price fluctuations are not so volatile that it will change between the time of the transfer and sell.

Once BitPay sells the bitcoin, they will transfer the cash into your account minus their fee. Let’s say that the cardholder loaded $100 and you charged the cardholder a 5% fee. The cardholder must transfer $105 of bitcoin to cover the transaction. BitPay will transfer 99% of that to your merchant account – $103.95.

Note that the sale and confirmation can take 15-30 minutes to be validated. This is due to a bitcoin limitation where it takes this long for all of its decentralized computers to update the blockchain (record of transaction). Once the sale is fully updated, then BitPay will tag the transaction as complete.

On a daily basis, BitPay will ACH funds to your pooled funds account. The transfers usually arrive the next day. In BitPay’s accounting system, they will allow you to transfer a percentage to that pooled funds account and the remaining is transferred to your bitcoin wallet. This can be a tricky calculation (see the example above) and I’ve included a spreadsheet to help you figure out this percentage based on your fee in my bitcoin bonus package. (Note at the time of this writing, BitPay only allows you to transfer whole percentages. You can transfer 98%, not 98.5%. Until they upgrade their system, you will need to get creative with your fee collection, transfers, and reconciliation.)

Your Prepaid Issuing Bank’s Responsibilities (Money Flows)

Ideally, the bank will only receive the $100 from the example above. If your bank has to net out fees, this could cause the program to be rejected or increase your costs with the bank.

The funds should be deposited directly into the pooled funds account. Your bank will want the accounts vs the deposit reconciled on a daily basis. At minimum, they will need a daily report from the processor showing all of the individual deposits.

Your Prepaid Processor’s Responsibilities (Money Flows)

To my knowledge, there are no processors that are connected directly to BitPay at this time. If you know differently, please let me know in the comments below.

Since this is the case, you will need to trigger your processor to load the funds onto the card. I recommend that you do this via API as these funds can be made available instantly. Once the Processor receives the API call, they can load the card with the appropriate transaction. If possible, use a transaction that is not currently in use to make your reconciliation process easier.

Once the funds are loaded, your processor should be able to generate an alert to the cardholder letting them know that the funds have been available.

Prepaid Program Manager’s Responsibilities (Money Flows)

When it comes to the money flow, the Program Manager has very little work. At minimum, you will want to identify the account where your collected fees will be deposited.

Secondly, you will want to reconcile the loads. For reconciliation, you will need to do the following:

- Compare the loads generated by the web page with the loads completed by BitPay to make sure all were successful.

- Review the daily ACH out of the BitPay Account to make sure it matches the total loads for the day. Note that each system may have different daily cut off times.

- Review the daily excess in the BitPay Account to make sure it matches your fees collected minus the BitPay Fee.

- Review the daily ACH deposit into the pooled funds account to make sure it matched against the amount sent from BitPay.

- Review the daily ACH deposit into the pooled funds account to make sure it matched the associated days loads in the processor’s system.

Prepaid Program Manager Project Responsibilities (Project)

As with most things in this business, the bulk of the work is going to fall on the shoulders of the Program Manager. The good news is that the work is largely front-loaded and there is little work outside of reconciliation on an ongoing basis.

As with most things in this business, the bulk of the work is going to fall on the shoulders of the Program Manager. The good news is that the work is largely front-loaded and there is little work outside of reconciliation on an ongoing basis.

The first step is to get the program approved by the bank and card network. This usually involves submitting the money flows, process flows, projections and a written description. You may need to meet with your issuing bank’s compliance team and reconciliation team to get them comfortable with the process.

Each issuing bank will be different on what they want you to include in the cardholder agreement. At a minimum, you will likely need to include the new velocity limits showing how much a cardholder can load in a day or month. Ideally, you want to keep this “load system” separate from the “card system.” This allows you to charge the fee outside the card and not need to disclose the exact fee in the cardholder agreement. This allows you to test the fees to arrive at your most profitable mix.

Since you know where the funds are coming from (the cardholder) and know where they are going (the card), you should not have to conduct CIP on the origination of the funds. Keep in mind though, if you open this up to allow anyone to send the funds to the cardholder, then you will likely need to know who your sender is via CIP.

After that, you will need to sign up for the BitPay Account. This is an easy, online process. Once signed up, you will need to opt into their Business plan which gives you higher limits but imposes a 1% transaction fee. Then you will need to request increased processing volume and request an exception to their terms as mentioned above. To do this, you can simply submit a customer service ticket.

Next, you will need to develop the technology. You will need to build a way for your cardholders to generate the sales receipt code. To do this, you will need to integrate with BitPay’s API and SDK. Ideally, this will take place on your own IT infrastructure, but if you do not host your own mobile app or website, it may need to be on your processor’s system. If this is the case, it may be a good time to migrate away from your processor’s system.

Once you have the sales receipt code generated, you need to trigger an API to BitPay looking for the message that the bitcoin sale is complete. Once the sale is complete, you need to load the funds to the cardholder’s account. I recommend doing this via an API to your processor’s system.

Keep in mind that to call the API to load the funds to the cardholder’s account, you will need to know who the cardholder is. One way to do this is to have the button that the cardholder clicks in your mobile app or on the cardholder website pass a card reference number. This is a number that the processor uses in place of the 16-digit card number. It is called something different by every processor. Your BitPay load page will use this card reference number when loading money via the API.

You will need to build out some rudimentary reports in your system showing how many loads were completed that day. These will be used by your issuing bank and your reconciliation team.

Lastly, you will need to limit your total amount that can be loaded via BitPay in a single day. If you are loading the funds on the card immediately, your issuing bank will want you to cap your loads for the day for your entire program. Many processors can handle this in their system, while a few cannot. If your processor is one of the few, you will need to build this velocity limit as part of the project. Note that there are also limits in the BitPay system if the issuing bank will allow you to use those limits.

Here is the Program Manager Flow once again as a recap.

What are the costs involved here?

Below is the general sense of the costs that could be involved in this project.

- IT development costs – Est $30,000 if you are already integrated with your processor’s API and up to $50,000 if you are not already integrated.

- Processor Costs – If your website and app are hosted by your processor, you will need to pay them to add a page and button to take the cardholder to an external page and pass a card reference number. You may also need to pay them for API work and reporting. You also may need to pay for additional transactions that hit the processor’s system.

- Customer Service – You will need to pay to train the customer service team on the new feature.

- Reserves – This is new area so BitPay may require you in the future to keep a reserve of funds on hand to cover any returns. If you implement like I suggested above, this will not be an issue for you. Your issuing bank, however, will want a 4x multiple of the daily maximum program load limit. This covers your bank for losses since you are giving cardholders access to funds immediately. Since BitPay sends the money the next day, you will need to cover a 1 day lag plus a 3-day delay that may occur over holiday weekends.

- Marketing – Once you launch this new feature, you will want to tell your existing cardholders about it. If you need to update your cardholder agreement, you will need to pay for the new materials and the notice to the existing cardholders.

- Operations – You will add about 5 hours per week to your financial operations staff.

- Bank – You may need to pay for the new product approval at your bank and see an increase in reconciliation fees or transactional fees.

What is the marketplace charging for fees?

To really understand the fees you can charge, it is best to understand what is being charged in this value chain today. These are the fees that your cardholder would pay.

- Purchase Bitcoin on Coinbase using a credit card – I paid $1.99 fee to buy $50 in Bitcoin.

- Transfer bitcoin to BitPay wallet – Until Coinbase updates their wallet to support the new URL based address above, you will need to transfer your bitcoin to a wallet that supports one. I transferred bitcoin from Coinbase to a desktop wallet provided by BitPay. A fee is paid in bitcoin to compensate the miners who make these transactions possible. To transfer $50 in Bitcoin, I paid 0.00001418 or $0.14 when one bitcoin was worth 9,782.38.

- Pay the sale receipt to move the funds from BitPay Wallet to Merchandiser – 1.5% of transaction.

- Your fee to the cardholder.

Let’s say the cardholder wanted to load $100 on his card. Based on the information above the cardholder would pay $1.99 to acquire the bitcoin. He would then pay $0.28 to transfer the bitcoin to a BitPay eligible wallet. He would then pay $1.50 to transfer the bitcoin to BitPay for the load and then whatever your fee is. That is a fee total of $3.77 plus any fees you charge. This may seem pricey, but the marketplace offers no alternatives.

Risks for Prepaid Program Managers

Keep in mind that cryptocurrencies, like bitcoin, are relatively new in the financial world, even though they have been around since 2009. Because of this, the risks are greater in some areas and less in others.

Keep in mind that cryptocurrencies, like bitcoin, are relatively new in the financial world, even though they have been around since 2009. Because of this, the risks are greater in some areas and less in others.

Financial – There are fewer financial risks when accepting bitcoin as a load mechanism than there are accepting credit card or bank to card loads. The financial risk with credit card and bank to card loads is a chargeback. There are regulations and industry rules that govern what happens if money is stolen from someone’s credit card or bank account and those funds are loaded to a prepaid card. Bitcoin does not have these regulations or rules – yet. If someone gains access to your bitcoin wallet and steals from you, you have no recourse. Thus, there are no chargebacks.

Regulatory – At the time of this writing, there are no state or federal laws that specifically govern this use of bitcoin. That may change, but it is unlikely to change overnight. The bigger risk is the networks (Visa, MasterCard, Discover). To minimize these risks, it is very important that you outline your program in as much detail as possible and not deviate during the implementation. Yes, the networks could change their mind and reverse their stance on converting bitcoin to cash and then loading the cash on a prepaid card. However, if they do change their mind, Program Managers will likely be given enough time to react. The part to watch out for is if your program deviates from the process approved by Visa and your bank. If this happens, your issuing bank or Visa can shut your program down without notice – and they have.

Reputational – As your program grows, consumer problems are going to be amplified. There is the risk that a hacker gets into someone’s bitcoin wallet and steals their bitcoin. That stolen bitcoin is loaded to one of your prepaid cards and the hacker makes off with that person’s money. The victim then takes to Social Media and gets the attention of national news outlets and your program is now a poster child for prepaid fraud.

Conclusion

I hope you found this article helpful and it will move you down the road in implementing this great new feature. Here are your next steps:

- Don’t forget to download the bonus package that contains a checklist for your project, some sample disclaimer language, and a fee worksheet calculator.

- As things in the industry change and I receive more information, I will update this article. If you are going to follow this process, bookmark the article and check back periodically.

- This is a complicated product to implement. Feel free to post questions in the comments section below.

- If you want help implementing this feature, click here to contact me. Once we sign a NDA, we will evaluate your program and give you upfront pricing that comes with a money back guarantee.